Businesses in 2026 are dealing with higher operating costs, higher software and subscription fees, and greater competition than they’ve faced before. To keep their businesses profitable, owners need to be deliberate in the way they spend their money and how they can be more efficient with their operations. The guide to cutting costs in 2026 offers actionable tips for becoming more efficient by eliminating waste, streamlining operations, and improving their financial performance without sacrificing quality or the customer experience.

Identifying and optimizing areas of expense that do not contribute to business growth is critical to cutting costs in 2026 for businesses successfully. By implementing best practices for improved efficiency, automating repetitive tasks, and making better business decisions, small businesses can build a stronger financial foundation while serving customers in the way that is most effective.

1. Conduct a Monthly Review and Evaluation of Your Business Expenses

The first step in cutting costs in 2026 is to conduct an exhaustive review of your recurring expenses. Many businesses are still subscribed to services and support that no longer have any value for them. You may be pleasantly surprised by the amount of money you can save from an expense audit.

Examine each piece of software, membership and service you are paying for on a monthly basis. Find out if you are paying for software that you no longer need, if multiple companies are providing you with the same service, and if you are using any services that are no longer being utilized. Many small businesses find that they can save a significant amount of money by eliminating these expenses.

2. Automate Redundant Tasks to Lower Staffing Expenses

Payroll expenses are significant expenses for small business owners. Using automation technology to manage payroll operations saves time and money. Many businesses use automated appointment reminders, recurring invoices, process payment follow-ups and create reports that reduce employee workloads and help them concentrate on growing revenue. In addition to improving productivity, automated systems reduce mistakes and improve cost-effective business management.

3. Negotiate with Vendors and Service Providers

Negotiation is one of the easiest ways to save money in 2026. Vendors want long-term customers and will offer better terms to retain your business. Most business expenses, including software subscriptions, payment processing fees, internet services and equipment lease agreements, can be negotiated.

Even small savings can accumulate, so it is worth reviewing your agreements and requesting lower rates regularly to save in 2026.

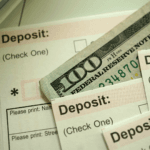

4. Strengthen Cash Flow with Better Payment Systems

Inefficient payment systems are quietly costing businesses money through high processing fees, late payments, and manual invoicing. As a result, improving your organization’s ability to collect payment for services rendered will be one of the most significant ways to cutting costs in 2026.

Examples of how to do this include:

- Implementing automated billing.

- Adding an ACH payment option.

- Implementing a fraud protection option.

- Creating a transparent process to collect payment from clients.

All of these options will reduce the number of mistakes made, and the likelihood of missed payments, and improve the ability to predict revenue in 2026.

5. Low-Cost Marketing That Still Gets Results

Marketing does not have to be expensive to be effective. Consider using short form videos, email marketing, and referral programs as means of reaching your target customers.

Cost Effective Marketing Tactics

- Creating short form videos rather than outsourcing the services.

- Repurposing your existing content on various platforms to increase reach.

- Using referral programs to encourage customers to refer you to their friends and family.

- Building email/text lists so you can reduce your reliance on paid advertising.

By utilizing these methods, small business owners can promote their brands and enhance their visibility while reducing their marketing expenses in 2026.

6. Focus on Retaining Customers

Retaining your current customers is the most effective way to reduce costs in 2026. The expense of maintaining an existing customer is significantly lower than that of acquiring new customers. Companies can keep their customers longer by improving the onboarding process, providing memberships, and offering fast, reliable customer service and support. Even small incremental improvements in customer retention will produce significant cost savings in the long term through greater lifetime value.

7. Consolidate Multiple Software Systems to Reduce Cost

Businesses often utilize several different software programs for billing, scheduling, reporting, and managing customer-related activities. This increases companies’ operational costs and complexity. Consolidating the business’s software tools into a single comprehensive tool is one strategy for reducing operational costs in 2026 while simplifying daily operations.

Use a Single Comprehensive Software Tool

Use a system that includes billing, payments, reporting, and customer management capabilities. Eliminating duplicate tools that serve the same purpose is a way to cutting costs. Streamline processes and workflows so the staff does not have to navigate multiple systems to complete their work. The fewer software tools used, the fewer fees associated with them, fewer mistakes made, and improved efficiency.

8. Identifying Hidden Costs Via Reporting

Reporting has strong implications regarding projected savings. The extent to which many companies underestimate how much they are losing each year to hidden inefficiencies creates an enormous amount of uncontrolled financial waste. Reviewing financial statement data may help you identify several fitness trends and prepare accordingly for future periods in order to reduce your overall operational expenses each month.

Reporting Helps You Reveal Hidden Costs

- Products/services are not generating sufficient margins.

- Late/missed payments can lead to company cash disarray.

- Trends in performance can help to make better informed business decisions.

Reporting provides actual data to support company operations, thereby implementing ongoing and long-term expense reduction efforts.

How Gulf Management Systems Will Allow Businesses to Save Money In 2026

Companies using Gulf Management Systems in 2026 will see drastic cuts in their payment processing costs and could achieve an immense amount of savings versus traditional payment methods.

GMS provides a payment solution that allows businesses to pay for transactions with ACH payments, which only charge a set fee (usually $0.50) no matter how large the payment is. Businesses that regularly need to process large payments, for example, memberships, recurring monthly service fees and subscriptions, will see these savings grow quickly. As companies switch from using traditional payment processors to using GMS for ACH payment processing, they can expect to reduce their processing costs by up to 75% and create additional cash flow and bottom-line improvement.

Additionally, with GMS services, businesses have less risk of payment failure due to declined/expired payments. The result is fewer lost transactions, no need to chase down customers to collect payment, and more of their income getting deposited into their bank account on time. When combined with lower fees, higher collection rates and an easy-to-use computerized payment transaction system, GMS is not merely just a payment processor. GMS provides businesses with the strategic advantage of enhanced cost savings and operational efficiency.

The post Guide to Cutting Costs in 2026 for Small Businesses appeared first on .